Korean Economy

Korean economy grew 0.4% in the first quarter of 2016

Korea's quarterly GDP growth slowed to 0.4% in the first three months of 2016, the lowest in nine months, due to falling exports and weak consumer spending. This figure represents a slowdown from a 0.7% expansion in the last quarter of 2015 but a 2.7% growth from a year earlier.

Consumer spending slid 0.3% in the first quarter of this year, while public spending increased 1.3% as a result of the frontloading of the government budget for the first three months. Since the second quarter of last year when the economy was hit by the outbreak of the Middle East Respiratory Syndrome (MERS), the government strived to encourage consumer spending to prop up the economy.

The effects of such effort did not last long, however, as it turned out, amid growing uncertainty on the global economy.

The country's first-quarter exports dipped 1.7%, driven by a decline in the exports of cars, coal and petroleum products. As of March, exports continued to decrease for 15 consecutive months, dragging down the overall economy. Imports also declined by 3.5% due to lower commodity prices, which boosted the current account surplus in the first quarter to USD 24.1 billion, the highest quarterly figure in record.

| Growth Rate | 2015 | 2016 | |||

|---|---|---|---|---|---|

| Q1 | Q2 | Q3 | Q4 | Q1 | |

| Gross Domestic Product | 0.8(2.4) | 0.4(2.2) | 1.2(2.8) | 0.7(3.1) | 0.4(2.7) |

| Consumer Spending | 0.8 | -0.1 | 1.1 | 1.4 | -0.3(2.1) |

| Government Spending | 0.5 | 0.9 | 1.3 | 1.0 | 1.3(4.5) |

| Construction Investment | 5.5 | 1.8 | 3.3 | -2.4 | 5.9(8.7) |

| Equipment Investment | 0.5 | 0.8 | 1.8 | 0.5 | -5.9(-3.0) |

| Intellectual Property Investment | 1.7 | -0.6 | 0.3 | 0.7 | 0.1(0.7) |

| Exports | 0.6 | -0.1 | -0.3 | 2.1 | -1.7(0.1) |

| Imports | 0.9 | 0.4 | 1.4 | 3.2 | -3.5(1.4) |

| Gross Domestic Income | 3.5(6.1) | 1.0(6.4) | 1.0(7.0) | 0.7(6.1) | 2.8(5.4) |

(Source: Bank of Korea)

*Figures in ( ) represent year-over-year growth rates.

Bank of Korea lowered its 2016 economic growth outlook to 2.8%

The Bank of Korea (BOK) cut its economic growth forecast for 2016 to 2.8% on April 19, down 0.2%p from its previous outlook released in January, citing Korea's weak first-quarter economic performance amid slower-than-expected global economic growth. Potential challenges that pose risks to the local economy include high exposure to China, declining export competitiveness, interest rate hikes in the US and slowing growth of the emerging economies. In particular, Korea's exports have continued to decline due to softening demand from China, which is the nation's top trading partner. Falling oil prices also reduced the value of exports by local oil refiners. The central bank expects the nations' exports to improve later this year, given signs of improvement in the Chinese economy and a moderate recovery in international oil prices. Meanwhile, it also lowered its outlook for consumer price inflation in 2016 from 1.4% to 1.2% due to the slowing economy.

Earlier in April, the International Monetary Fund (IMF) slashed its forecast for Korea's economic growth this year to 2.7% from its previous estimate of 3.2% made in October last year, saying that a slowdown in China has weighed heavily on Korea's exports. It also said that Korea faces some downside risks including a sudden outflow of capital due to weakening investor appetite for emerging markets. As the world economy is increasingly at risk of stalling, the IMF downgraded its global economic growth outlook for this year once again to 3.2%, down 0.2%p from its projection issued in January.

Private economic research organizations in Korea released even lower forecasts for the nation's economic growth in 2016. Hyundai Research Institute cut its forecast from 2.8% to 2.5%, while LG Economic Research Institute lowered its outlook from 2.5% to 2.4%. The Korea Institute of Finance also slashed its forecast from 3.0% to 2.6%.

| Growth Rate | 2014 | 2015 | 2016(E) | ||

|---|---|---|---|---|---|

| First Half | Second Half | Annual | |||

| Gross Domestic Product Consumer Spending Equipment Investment Construction Investment |

3.3 1.7 6.0 1.1 |

2.6 2.2 5.3 3.9 |

2.9 2.6 -1.1 6.7 |

2.6 2.0 2.8 2.4 |

2.8 2.3 0.9 4.4 |

| Unemployment Rate | 3.5 | 3.6 | 4.0 | 3.3 | 3.6 |

| Current Account Surplus(USD billion) Exports Imports |

84.3 2.3 1.9 |

105.9 -8.0 -16.9 |

50 -8.4 -10.5 |

46 0.7 2.2 |

96 -3.9 -4.2 |

| Consumer Price Inflation Three-Year Treasury Yield KRW/USD Exchange Rate (KRW) |

1.3 2.6 1,053 |

0.7 1.8 1,132 |

1.0 1.8 1,205 |

1.4 2.1 1,198 |

1.2 1.9 1,201 |

(Source: Bank of Korea)

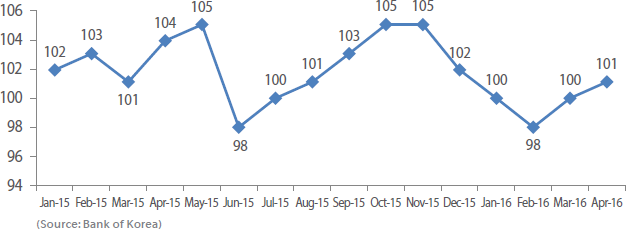

Consumer confidence slightly improved in April

Korea's consumer confidence edged up in April, with positive consumer outlook for economic situations outweighing pessimism. The latest data released by the Bank of Korea showed that the country's composite consumer sentiment index (CCSI) stood at 101 in April, up one point from the prior month. The CCSI is based on a survey of around 2,200 households, and a reading above 100 means optimists outnumbers pessimists. The index continuously dipped from 105 in November 2015 to 98 in February 2016 and then started to turn upward in March. The improvement in consumer confidence came as good news to Korea's economic policymakers, who were struggling to boost domestic demand to shore up the economy.

Four of six sub-indexes improved - prospective living standards (98 from 97 in March), household spending (106 from 105), present domestic economic conditions (74 from 69) and prospective domestic economic conditions (86 from 82) - whereas the rest two indexes - present living standards (91) and prospective household income (99) - were unchanged.

Between 1998 and 2016, consumer confidence in Korea averaged 100.80, hitting a record high of 117 in October 2009 and an all-time low of 81 in December 2008.

Financial and foreign exchange market update for April 2016

The Korean stock market as of the end of April held mostly steady compared to the previous month, with market capitalization down 0.2% month over month. The Korean Composite Stock Price Index (KOSPI) hit a yearly high of 2,022p during April in the midst of a modest increase in international oil prices and improving trade conditions in China, before declining back to the below 2,000 levels on concerns of U.S. economic slowdown. Indeed U.S. economic growth weakened sharply in the first quarter to its slowest pace in two years as consumer spending fell and a strong dollar continued to dampen exports.

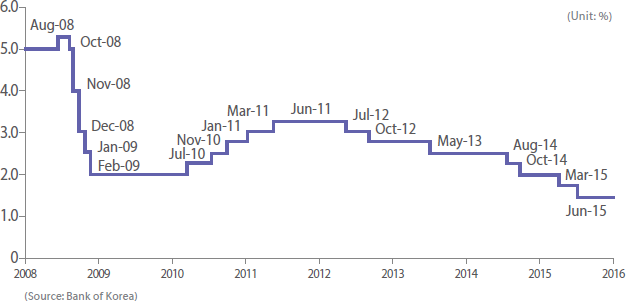

The yield on three-year Korea Treasury Bond has remained largely stable at around 1.45% over the past several months since it reached a new low of 1.431% on February 16, 2016. The central banks of developed countries are resorting back to easy monetary policies due to the slowdown of the Chinese economy and global economic and financial uncertainty arising from falling oil prices. The Bank of Korea maintained its benchmark interest rate at 1.5% as the latest economic data showed signs of improvement, which reduced the pressure on the BOK to lower the rate.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Feb. 2016 | Mar. 2016 | Apr. 2016 | |

|---|---|---|---|---|---|---|---|---|---|

| 3-year treasury |

3.38 | 3.34 | 2.82 | 2.86 | 2.10 | 1.66 | 1.45 | 1.44 | 1.45 |

| 5-year treasury |

4.08 | 3.46 | 2.97 | 3.23 | 2.28 | 1.81 | 1.56 | 1.55 | 1.55 |

(Source: Bank of Korea)

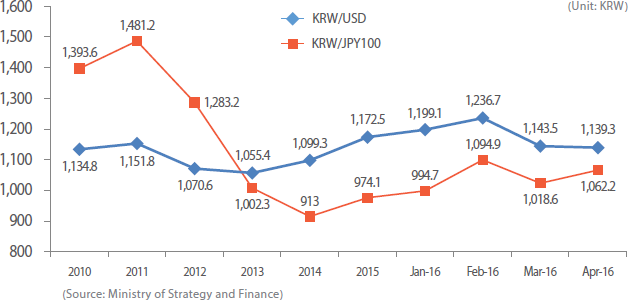

The Korean won traded at around KRW 1,140 - 1,150 against the US dollar during the month. As the US Fed seemed likely to remain accommodative for the time being, the won closed at KRW 1,139.3 against the greenback at the end of April, up 0.4% from the previous month. Against the Japanese yen, the exchange rate was down 4.1% to KRW 1,062.2 per JPY 100 as no additional stimulus measures were released by the Bank of Japan.

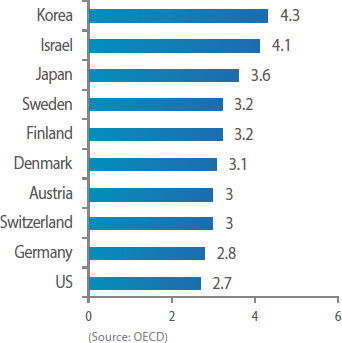

Korea takes lead in R&D investment globally

Korea has become the world's most research-intensive economy according to data released in February 2016 by the Organization for Economic Cooperation and Development (OECD). Korea spent 4.29% of its GDP on research and development (R&D) in 2014, taking the top spot among 41 economies followed by Israel at 4.11% and Japan at 3.58%. Rising industrial investment is the key driver behind the increase in Korea's R&D spending, and the nation plans to invest 5% of its GDP in R&D by 2017. China's R&D expenditure is also growing fast, with the share of its GDP devoted to R&D reaching 2.05% in 2014, which surpassed that of the EU (1.94%) for the first time. In the corporate world, Samsung Electronics, a Korean multinational electronics company, ranked as the world's second-biggest corporate spender on R&D after Volkswagen, which remained at the top position for the third consecutive year.

The 2016 Bloomberg Innovation Index ranked Korea as the most innovative economy in the world, ahead of Germany, Sweden, Japan and Switzerland. The index evaluated countries using factors such as R&D spending and concentration of high-tech public companies. Korea notched top scores worldwide for value added in the manufacturing sector as well as for tertiary efficiency - a measure that includes enrollment in higher education and the concentration of science and engineering graduates, according to a Bloomberg report.

| Rank | Country | Total Score |

|---|---|---|

| 1 | Korea | 91.31 |

| 2 | Germany | 85.54 |

| 3 | Sweden | 85.21 |

| 4 | Japan | 85.07 |

| 5 | Switzerland | 84.96 |

| 6 | Singapore | 84.54 |

| 7 | Finland | 83.80 |

| 8 | United States | 82.84 |

| 9 | Denmark | 81.40 |

| 10 | France | 80.39 |

(Source: Bloomberg)

Government pledged to invest KRW 145.5 billion in self-driving cars

The development of autonomous cars will kick into high gear in Korea as the government pledged to spend KRW 145.5 billion on self-driving technology over the next five years from 2017. The investment is aimed to encourage and support the local automobile and other related industries to speed up the development of key technologies of driverless vehicles so that they could get ahead of global competition in this new field. The eight key areas that the government will be funding include digital maps, camera and radar modules, which are essential to keep cars in the center of their lane and cruise with traffic. The Ministry of Trade, Industry and Energy will also address regulatory issues that may hold back the development of the self-driving vehicle sector. In addition, the government will raise a KRW 7 billion fund to invest in the so-called automotive convergence alliance, which was set up in December 2015 to expedite technological development and promote joint research projects in the related sectors. The alliance consists of more than 90 companies in the automobile, software, information and communications technology and materials sectors.